Computer America has, over the past few years, and really, since near the beginning of the Bitcoin/cryptocurrency talked about the technology and the culture surrounding it. Admittedly, we didn’t get into bitcoin when the majority of the uses involved illegal substances/services. Heck, we didn’t get into these even AFTER they became mainstream. Doing a nationally syndicated radio program on technology, and being able to be completely removed from the rise and fall of the markets, has been a wise move. Friends have made thousands, others have lost thousands, but through it all, I have remained a passive observer. That I believe gives me a unique perspective when it comes to cryptocurrency. Because many of those who claim expertise, have a sizable holding on an “alt-coin” or Bitcoin itself. This article will look into some of shortcomings of bringing a hyper-hyped tech buzz concept to market.

8-Ball Says Screwball Investors

8-Ball Says Screwball Investors

One of the big problems with cryptocurrency is getting information. Plenty of YouTube content creators will be your shining beacon in these shrouded arenas. Articles from even the most mainstream media outlets will speculate on the future of these coins. But objective information on the inner-workings of crypto are few and far between. I believe this has much to do with the nature of these coins. You do not have to report them to any central agency. You can remain anonymous. They are overall, dark money.

And if you know your word has the power to influence the price, personal gain is a very possible.

Fortune Cookies Are Good Advice

As I mentioned before, many people, from large to small organizations, will speculate on the price. Billionaires will say they believe in the future of cryptocurriences. Analysts claim that despite any slump in price, any surge, it is all temporary or not enough, and $50,000 is on the horizon. If you believe, if you eat your toast burnt side down, if you just hodl hard enough, there are riches to be had.

The truth is, like anything else, nothing is a sure thing. And everyone who claims to know what will happen, is simply pushing for a self-fulfilling prophesy. As we have seen, there are countless stories for people who have taken the advice of complete strangers, and lost everything. Not an unusual story in investing, but perhaps all the more sad when you consider the age and how impressionable the audience for cryptocurrency is.

Power Overwhelming

The full impacts of cryptocurrency continue to unfold. One of the unintended impacts that “mining” for Bitcoin has been the demand for electricity. The distributed ledger system behind Bitcoin was not made with efficiency in mind. Other alt-coins have, but those have value closely tied with Bitcoin itself, and therefore are at no point going to replace the more dominant coin. When you rank between Isreal and Bangladesh in terms of energy consumption, you have something quite unsustainable.

Admittedly, as the price of Bitcoin has plummeted, the people looking to make money from simply mining has decreased, as it is no longer possible to do so. But should the price take off again, the environmental cost of Bitcoin will have to be factored in. Although with no central agency to make that call, profits will outweigh penguins in this case, and outside forces may step in to control cryptocurrency mining.

Smoke and Smoke and Mirrors of Smoke

All of this is a lot to follow. And when all understand is “Fear of Missing Out”, or FOMO, the noise tends to be cranked up to your detriment. Capitalizing on this confusion are people happily leaving novice or gullible investors with the bill.

To a smaller degree of Bitcoin itself, take a look at this article about John McAfee. Through private messages, he would entice his inner circle to invest in a coin of their choosing. Allowing people to buy in before a spike. This spike would attract speculative investors, who would buy at the inflated price hoping to ride the rise. After a few hours or days, the inner circle would sell off immediately, and causing the coin to collapse. The inner circle cashes out, leaving everyone else in the market holding the bill.

There is evidence this same scam was perpetrated on Bitcoin itself, and in many other markets. While not illegal, people who truly understand not just the technology, but the culture, will continue to take advantage of anyone else joining in.

A Coin By Any Other Name, Is Just As Ruined

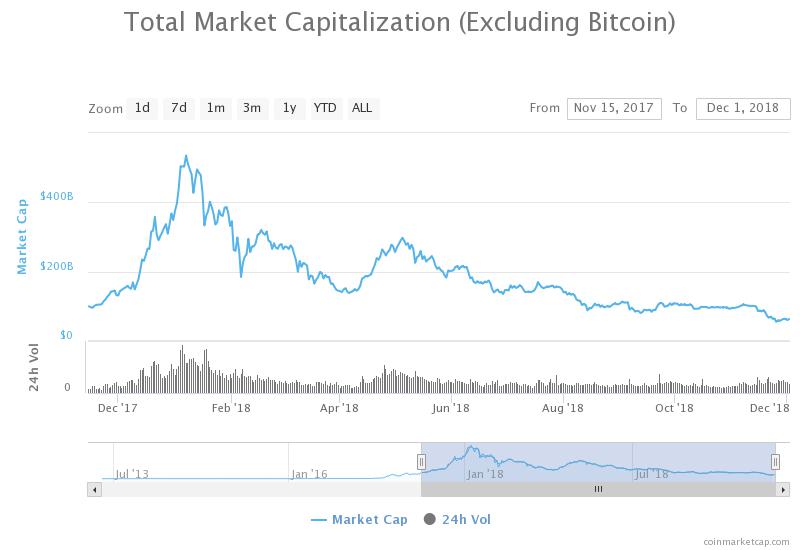

All of this, with the fluffy as air, often cheaper than air “alt-coins” adding to the market. At one point, there was nothing but Bitcoin. As cryptocurrency was further explored after the 2017 boom, bitcoin was 90% of the market. Followed by startups, some with few a tweaks, others with none but in name, Bitcoin fell to 35% of the market capitalization, with others showing strong gains.

All of this, with the fluffy as air, often cheaper than air “alt-coins” adding to the market. At one point, there was nothing but Bitcoin. As cryptocurrency was further explored after the 2017 boom, bitcoin was 90% of the market. Followed by startups, some with few a tweaks, others with none but in name, Bitcoin fell to 35% of the market capitalization, with others showing strong gains.

Now we are looking at 54% and climbing as these alt-coins are starting to get sold off/money siphoned out. A strong market will never happen as long as people don’t believe in the currency, but rather are looking for their quick dollar. which we can only assume

Bitcoin, Cryptocurrency, Blockchain, Not The End

There are billions of dollars lingering in coins. Millions of people hoping to make a buck. Thousands of uses claiming to be the next best thing. Hundreds of coins a year springing up. Tens of reasons not to invest/use, many of them barely scratched in this article.

The one lesson I hope you leave here is this. Cryptocurrency, and Bitcoin, is something special. It’s a cultural milestone, and while not a technological pinnacle, maybe a marketing one. I truly see the idea of a distributed, verifiable, immutable ledger being incredibly useful, as it has been and will continue to be for years to come in the right context.